Breadcrumb

- Home

- USW Analysis Shows Russian Intervention Has Fueled Every Wheat Price Spike Since 2007

Editor’s Note: This article was originally authored by USW President Vince Peterson and published by USW on March 9, 2023. This article has been shortened and adapted for the Kansas Wheat Scoop. Find the full version at uswheat.org.

Headlines from the Black Sea region continue to move markets more than a year after Russia’s unprovoked invasion of Ukraine. Recent analysis from U.S. Wheat Associates, the industry's export market development organization, shows the impact of Russian interventions in the market extends far beyond the current conflict and has been an underlying source of dramatic global wheat price volatility.

Over the years, Kansas wheat farmers answered the call to supply additional wheat to the world when the Russian government banned or restricted exports of wheat. However, with historically tight hard red winter (HRW) wheat supplies and Russia’s invasion of Ukraine, price volatility reached record levels last year, said Mike Spier, Vice President of Overseas Operations with U.S. Wheat Associates.

“Russia’s government meddling clearly adds uncertainty and volatility in the market and that does make it more difficult for Kansas farmers to market their wheat,” Spier added.

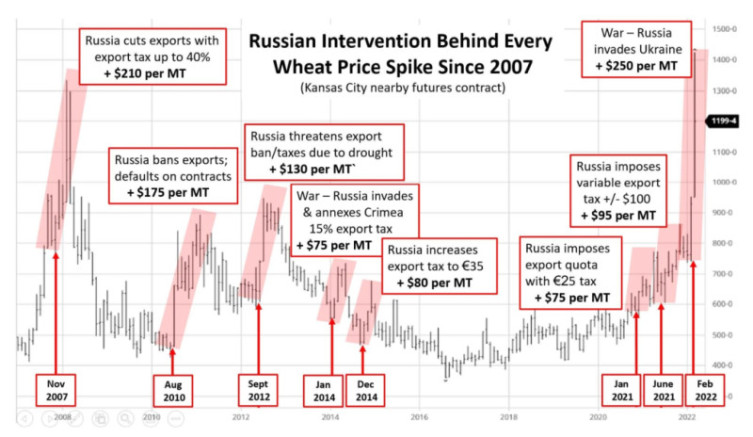

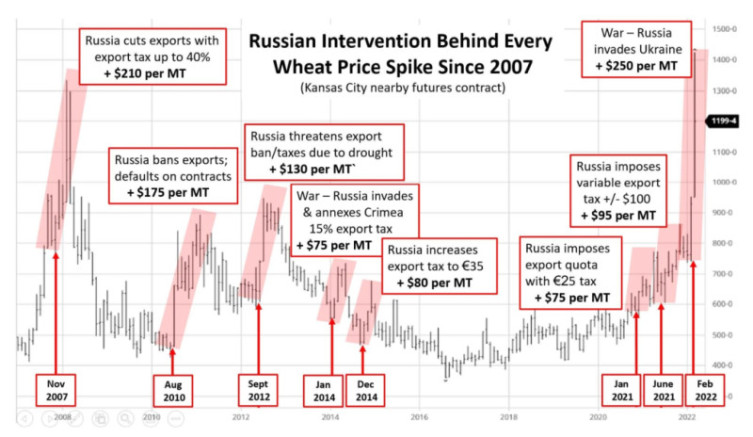

In six documented situations since 2007, when the global wheat market showed any sign of stress, the government of Russia stepped in to impose an export ban, export tax or export quota to isolate their home market. These actions intentionally limited world wheat importers’ access to Russian wheat supplies. This Russian intervention further magnified any supply shortage and accelerated the rise in wheat prices.

Twice in this time frame, Russian military aggression against Ukraine directly caused world wheat prices to spike sharply. The world is reeling viscerally and economically from the shock of that situation right now.

“…We are closely monitoring prices for the most essential social goods such as food, including bread,” said Russian Prime Minister Mikhail Mishustin in early March about its domestic wheat supply. “Russian grain is in good demand from abroad, and its price is increasing. That said, it is necessary to provide the necessary raw materials, first of all, to the domestic baking industry.”

The Prime Minister made this comment with specific reference to the hyper reaction of global wheat prices to Russia’s invasion of Ukraine and the immediate impacts of the widespread economic sanctions levied on Russia in response. Yet it spotlights the core tenants of Russia’s protectionist and heavy-handed wheat supply and price control policies. Russian intervention has been front and center since the country first entered the global wheat export trade.

“Defending Russian domestic supplies and keeping domestic prices low by withholding supplies from the world will always be their primary wheat policy weapon,” wrote USW President Vince Peterson. “And they deploy it without regard for the harm and expense it creates for anyone.”

Underscoring this point, the Russian Ministry of Economy confirmed on Mar. 11, 2022, that they are banning wheat exports through Aug. 31, 2022, to their fellow Eurasian Economic Union member states, including its Ukraine invasion staging partner Belarus, along with Armenia, Kazakhstan and Kyrgyzstan.

Russia’s war on Ukraine has blocked nearly 30% of the expected wheat export supply from governments and people that depend on it the most. Uncertainty runs rampant. And it is almost impossible to know how this war will be prosecuted. How long it will persist? What will the physical and economic situation of Ukraine and Russia be at the end?

Market analysts everywhere are trying to assess the many implications of this latest Russian intervention. Who will be most severely impacted? What will be the magnitude of the shortage created in the global wheat supply chain? And how will the world’s remaining supplies be apportioned, priced and relocated to the most severely affected countries?

Such high prices and volatility create challenges for the world’s wheat buyers and farmers and grain traders, who must also use the futures market to manage price risk.

Kansas State University’s Department of Agricultural Economics is actively tracking the agricultural ramifications of the Ukraine-Russia conflict through regular webinar updates. A main resource for these updates is Antonina Broyaka, who moved to the United States from Ukraine following the Russian invasion and is serving as an extension associate on the issue of economic impact of Russian military aggression on Ukrainian agriculture and global food security.

Keep up to date with the latest analysis on the agricultural ramifications of the Ukraine-Russia conflict at agmanager.info and broader analysis of world wheat markets at uswheat.org.

###

This chart shows correlation between HRW futures price spikes and Russian intervention. Russian intervention is associated with the upward spike in hard red winter wheat futures prices. Factors include export restrictions, taxes and two invasions of its sovereign nation neighbor Ukraine. Source: U.S. Wheat Associates.